|

Indicator

|

EU indicator past trend

|

Selected objective to be met by 2020

|

Indicative outlook of the EU meeting the selected objective by 2020

|

|

Share of environmental and labour taxes in total tax revenues

|

Environmental taxes

|

Labour taxes

|

Shift taxation from labour towards the environment - 7th EAP

|

|

|

For the EU as a whole, there has been no positive progress over the examined period and there are no indications of any change in the coming years

For further information on the scoreboard methodology please see Box I.1 in the EEA Environmental indicator report 2016

|

Setting the Scene

The 7th EAP calls on the EU and Member States to consider ‘fiscal measures in support of sustainable resource use such as shifting taxation away from labour towards pollution’ (EU, 2013). This briefing presents trends in the shares of environmental and labour taxes in total tax revenues. The reasoning that it is more environmentally and economically sound to tax pollution and resource use than to tax labour is based on the theory that increased taxes on resources should incentivise a reduction in their use. Environmental taxation can allow fiscal consolidation while, at the same time, encouraging restructuring towards a resource-efficient economy (EC, 2011). Environmental tax reforms can change behaviour, redirecting consumption towards less taxed and less polluting commodities. Reducing taxation on labour and investment (for example income tax and corporation tax) can also encourage economic growth and, through targeted investment, can specifically encourage the creation of green jobs, for example in the recycling and energy efficiency sectors (EEA, 2013).

Policy targets and progress

The Roadmap for a Resource Efficient Europe (EC, 2011) includes a milestone that, by 2020, a major shift of taxation from labour towards the environment will lead to a substantial increase in the share of environmental taxes that contribute to public revenues, in line with the best practice of Member States.

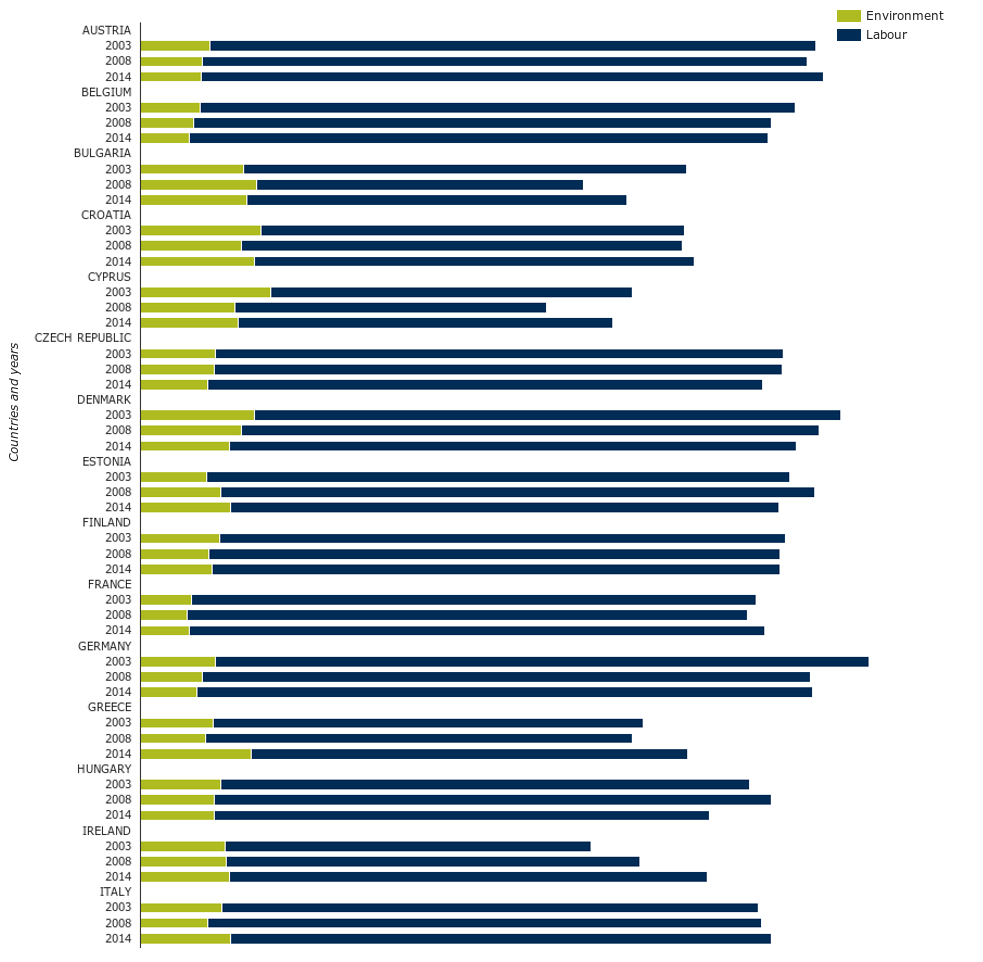

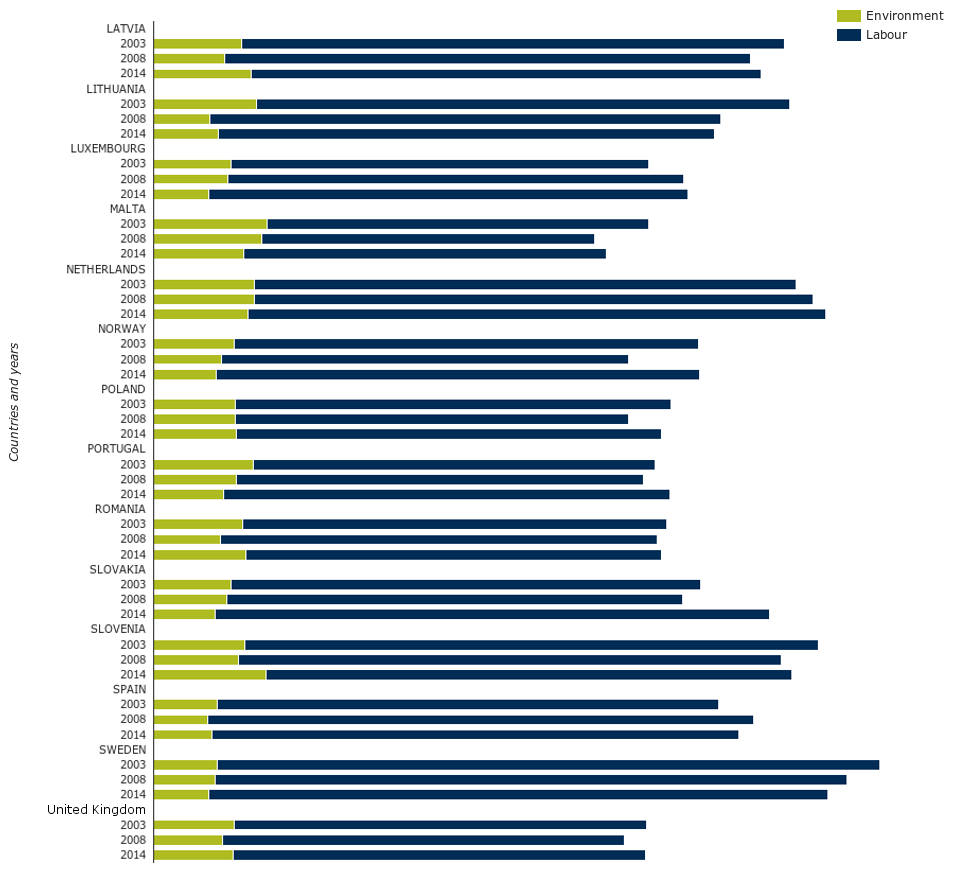

For the EU as a whole, there has been no positive progress over the last decade (Figure 1). At the beginning of the 2000s, there was a slight increase in environmental taxes relative to labour taxes, but, since the economic downturn, this has not been sustained. The share of total revenues from taxes on labour has consistently remained at approximately eight times that of revenues from environmental taxes.

The years following the economic downturn offered the opportunity to use environmental fiscal reform to address rising unemployment. The lack of any positive movement at the EU level indicates that this opportunity has not been capitalised upon. This lack of progress comes in spite of renewed interest in environmental fiscal reform driven by various factors, including the push for fiscal consolidation and the growing recognition of the financial burden of certain measures, such as fossil fuel subsidies. The recent sharp fall in global oil prices is seen by some as providing an opportunity to launch carbon-pricing mechanisms and to reform fossil fuel subsidies (IEEP, 2015).

In addition to taxing energy and carbon, resource taxes offer opportunities to improve material resource efficiency (see the Resource efficiency briefing (AIRS_PO2.1, 2016)1). Such taxes are still largely unused in the EU, comprising only 3.6 % of revenues from all environmental taxes in 2014, which corresponds to 0.09 % of gross domestic product (GDP) in the EU (Figure 2). There is no sign of an increase in the share of resource taxes in environmental taxes over recent years, despite an increasing focus on material resources in EU policy, represented, for example, by the 2011 Roadmap to a Resource Efficient Europe (EC, 2011) and the 2015 Circular Economy Package (EC, 2015a).

This lack of progress may be a result of a number of obstacles that have been identified in relation to environmental fiscal reform. In its 2015 review of tax reforms in Member States (EC, 2015b), the European Commission refers to three key barriers in relation to the implementation of environmental taxation: (1) the potentially regressive nature of environmental taxes and possible associated equity issues; (2) the potentially harmful effect on the competitiveness of the sectors concerned; and (3) the administrative and enforcement costs of raising these taxes. The Commission, nevertheless, offers successful implementation strategies, namely transparency and early engagement with those affected by the tax, gradual implementation of the tax according to a pre-announced schedule and making such tax measures part of a broader policy package designed to achieve the specific environmental objective.

Analysis by the European Commission also suggests that higher energy taxes, compensated for by a reduction in labour taxation, can, in fact, improve competitiveness (Barrios et al., 2014). However, the administrative and enforcement costs must be in proportion to the political and environmental objectives that the tax aims to achieve. Other studies also suggest that any potentially negative impacts of environmental taxes can be reduced or addressed through careful design and implementation of tax adjustments (IEEP, 2015).

Another factor that limits changes to the relative levels of taxes is the high level of political attention that is generated by any changes to a country’s tax system. This can make any changes difficult and will tend to slow the pace of change. The political difficulties of modifying the fiscal system are reflected in a recent study by the European Commission, which assessed the environmental fiscal reform potential for the EU for different scenarios of political acceptance in various Member States (EC, 2016).

The absence of policies promoting a tax shift from labour to environmentally damaging goods and practices over past years, and the lack of plans by Member States to implement these changes, makes it unlikely that the 2020 objective will be met.

Country level information

When comparing the levels of environmental taxation between European countries, differences should be analysed with caution. For example, low revenues from environmental taxes can result from relatively low environmental tax rates, or from modified behavioural patterns resulting from high tax rates. On the other hand, higher levels of environmental tax revenues in a country could result from low tax rates that incentivise non-residents to purchase taxed products from the other side of a border (as is the case for petrol or diesel) (Eurostat, 2016).

Data sources:

Eurostat. Shares of environmental and labour taxes in total tax revenues from taxes and social contributions (tsdgo410)

European Commission. Data on taxation

Explore interactive version

Figure 3 illustrates the large differences in the share of labour taxation in 2014 between countries, ranging from 32.9 % in Bulgaria to 58.6 % in Sweden. In 2014, only three EU Member States (Croatia, Greece and Slovenia) showed a share of above 10 % of environmental taxes in total revenues from taxes and social contributions.

Five countries shifted taxation away from labour and towards the environment between 2003 and 2014 (Bulgaria, Estonia, Latvia, Poland and Slovenia), while 10 countries moved in the opposite direction (Austria, Croatia, Cyprus, Finland, France, Luxembourg, Portugal, the Netherlands, Slovakia and Spain); however, some of these changes are quite small.

The 2015 review of tax reforms in Member States by the European Commission (EC, 2015b) identified a group consisting of approximately one third of EU Member States where there is particular scope for improving the design of environmental taxes. Suggested ways forward include restructuring vehicle taxation, indexing environmental taxes to inflation and adjusting fuel excise duties to reflect the carbon and energy content of different fuels.

Outlook beyond 2020

A recent report by the European Commission analysed the extent to which environmental taxes could be increased, based on good practice (EC, 2016). This report found that environmental taxes could increase across the EU from an average of 2.5 % of GDP in 2013 to 3.6 % by 2030. Countries reported that politically feasible increases in environmental taxes, especially energy taxes, are lower than estimated optimal rates. However, this gap reduces as one looks further into the future. The report concluded that, while, in the short term, the good-practice scenario is viewed as challenging, over the longer term nearly all the suggested taxes can be viewed as politically feasible.

The fiscal outlook in Europe has heightened political interest in the potential of revenue-neutral tax-shifting policies whereby the revenues from environmental taxes are used to reduce labour taxes. Longer term developments, including demographic changes and technological breakthroughs on energy and transport in the transition to a low-carbon, green economy, will contribute to the erosion of the current tax bases in European countries. These expected trends challenge the overall basis of current thinking on tax shifts. Some countries have already developed new environmental tax instruments, but much more work needs to be done on the design of resilient, long-term tax systems in Europe in the face of such systemic challenges (EEA, 2016).

About the indicator

Environmental taxes are defined as taxes whose tax base is a physical unit (or proxy of it) of something that has a proven, specific negative impact on the environment. Current environmental tax revenues stem from four types of taxes: energy taxes, transport taxes, pollution taxes and resource taxes. Pollution and resource taxes are reported for only 16 EU Member States, with Eurostat estimating the tax levels for the remaining countries.

Taxes on labour are defined as all personal income taxes, payroll taxes and the social contributions of employees and employers that are levied on labour income (both employed and non-employed).

Eurostat gathers data on environmental taxes for four categories (energy, transport, pollution and resources) using Table 9 from the European System of Accounts transmission programme. Since 2013, Eurostat has also collected data on environmental taxes by economic activity at a more detailed level, in application of Regulation (EU) No 691/2011 on European environmental economic accounts. The methodological basis is outlined in the Eurostat publication ‘Environmental taxes — A statistical guide’ (Eurostat, 2013).

Document Actions

Share with others