Source: Plastics Europe (2022).

Click here for different chart formats and data

Statistics on the processing activity of Europe’s plastic industry are often assumed to indicate Europe’s level of plastic consumption. This is, however, not the case, as these data relate to the raw material demands of European plastic converters and do not cover all plastics put on European markets, particularly plastics that used in textiles or are part of imported products. Moreover, plastics produced in Europe may be incorporated into exported goods, which are not placed on the market in Europe.

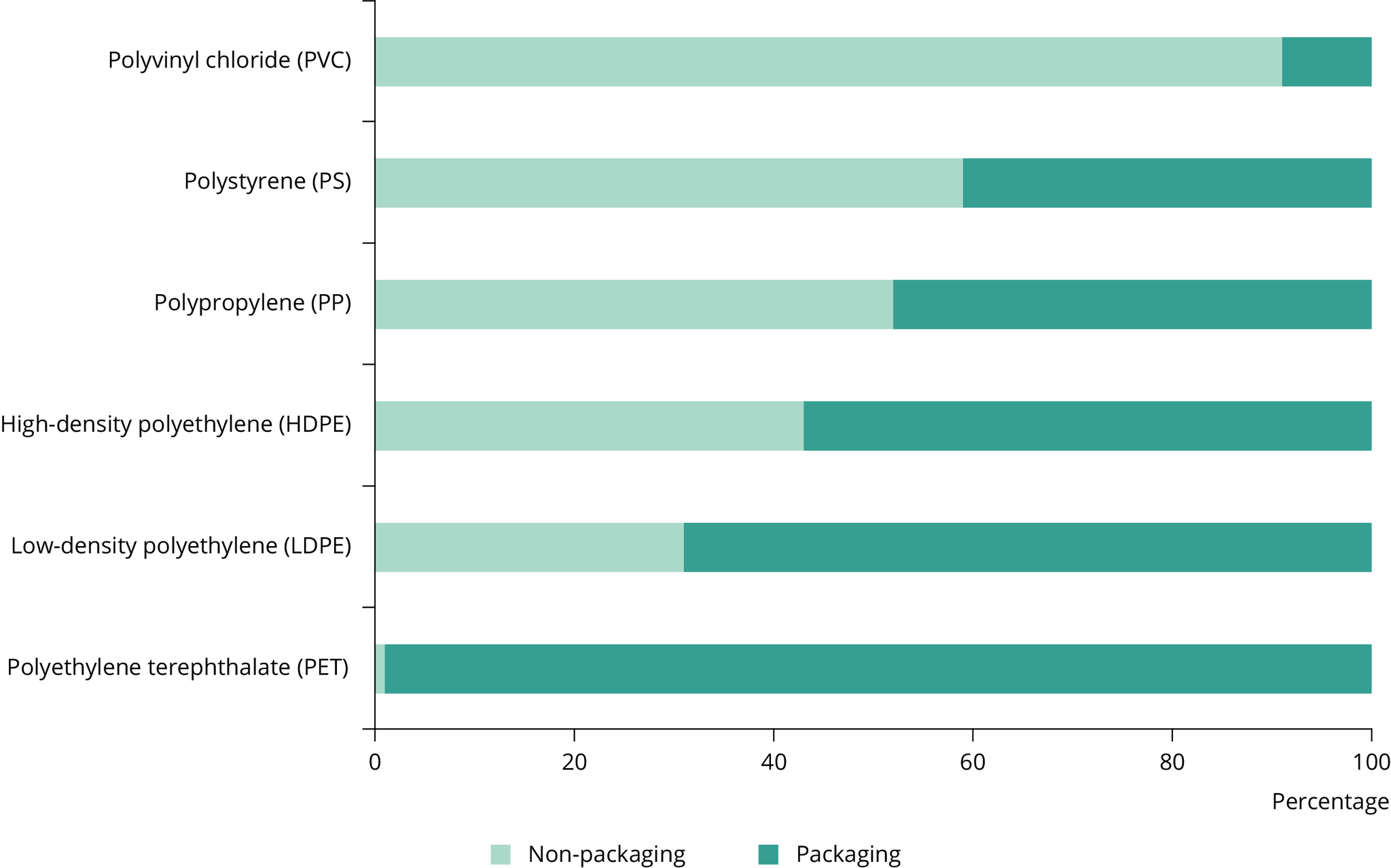

In line with projected development of consumption patterns, demand for manufactured products is expected to continue to increase across most sectors. These products will contain plastic components and so this will lead to increased consumption of plastics in non-packaging applications. In addition, pressure from policymakers and the public is likely to drive a decrease in the volume of plastic packaging - through material substitution and reusable containers. The combined influence of these changes suggests that the proportion of plastic associated with non-packaging applications in total plastic flows may become even larger in the years ahead.

Determining exactly how much plastic is consumed in Europe is clearly complicated. The 2022 Circular Economy package proposed by the European Commission estimates that 60% of plastics are used in non-packaging applications (European Commission, 2022), while recent detailed modelling concluded that 74% of all plastic consumed was used in non-packaging applications (Hsu et al., 2021).

Waste management

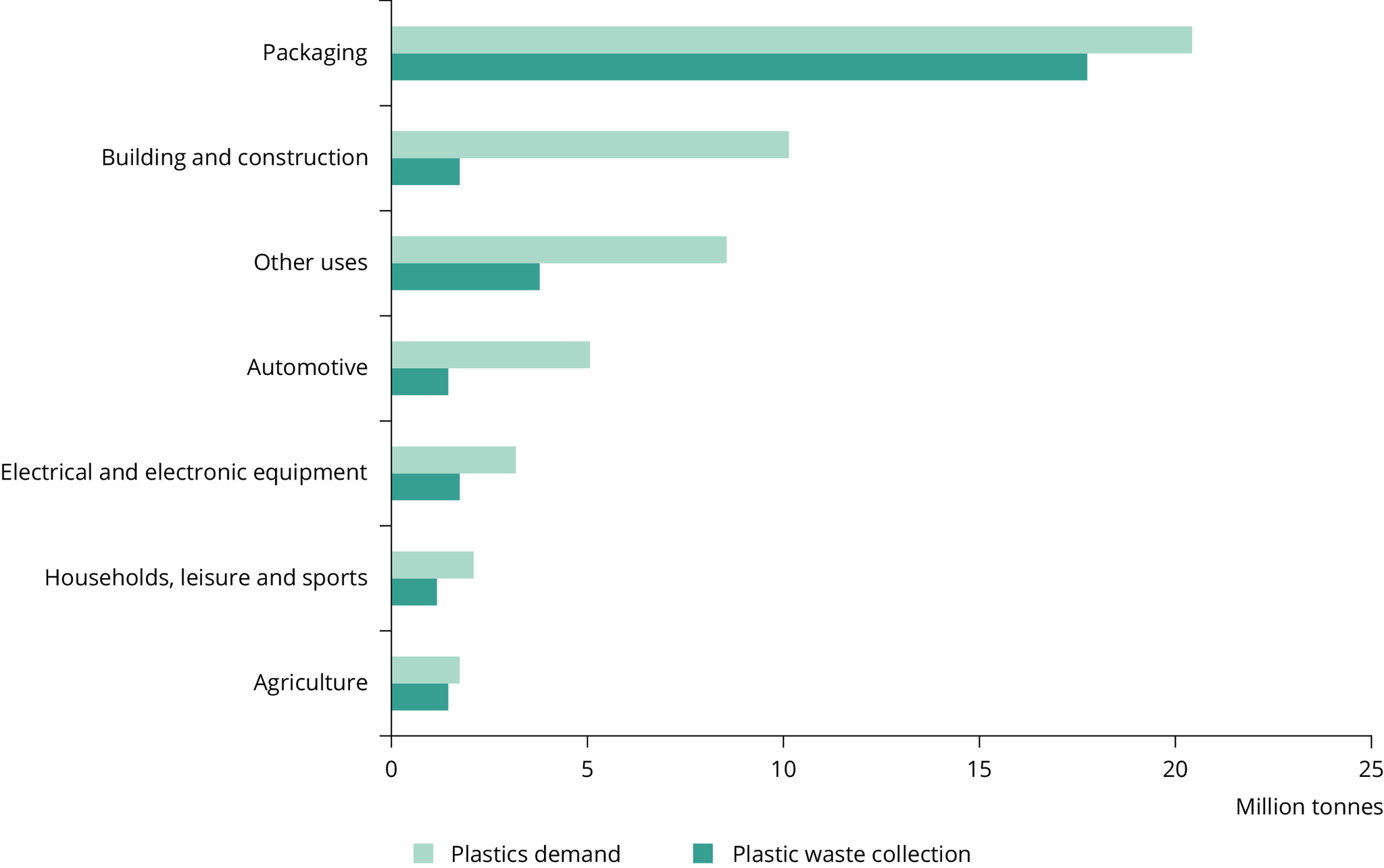

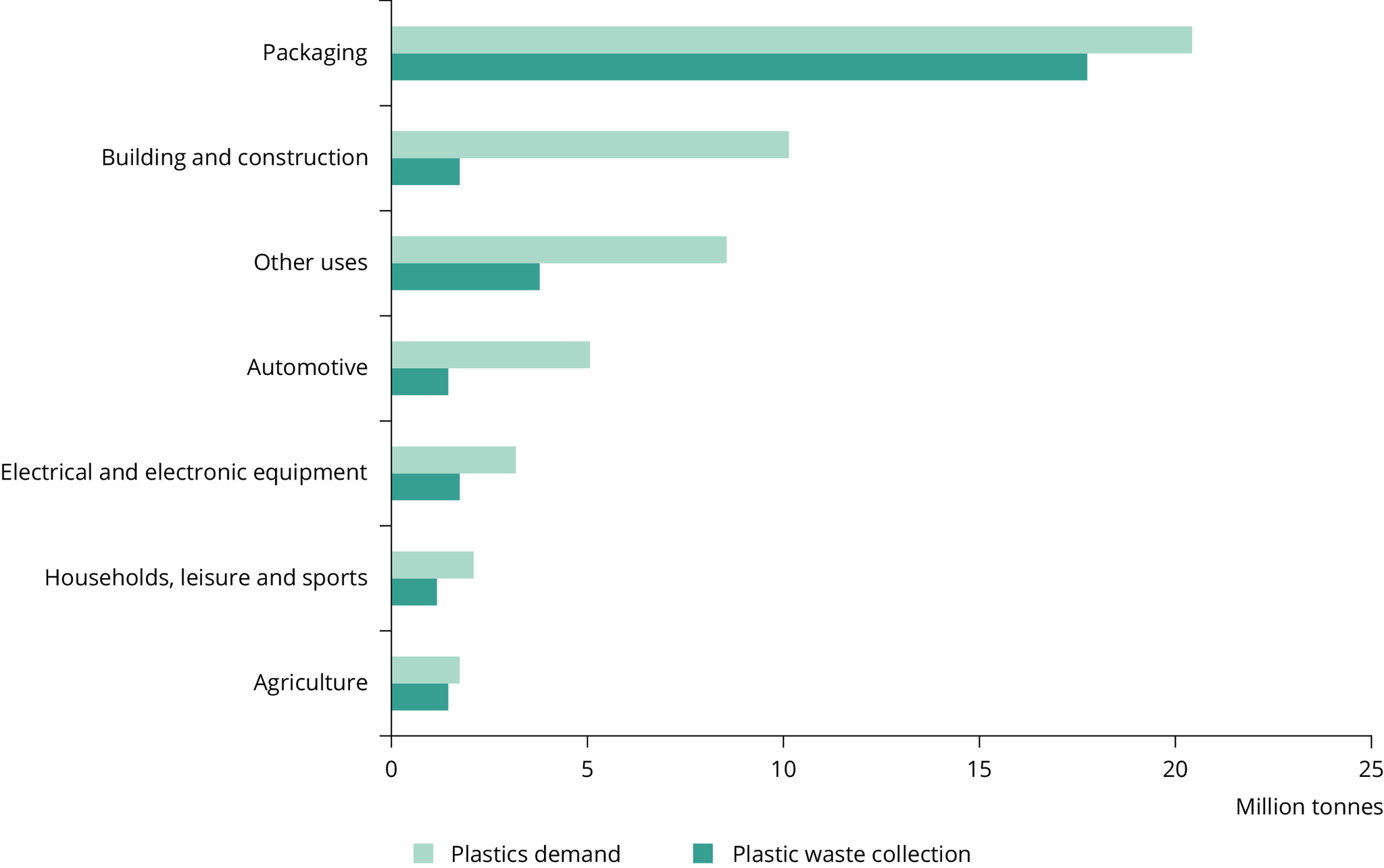

Non-packaging plastic products generally have a significantly longer service life than packaging products. For example, while the service life of plastic packaging is often only weeks or months, plastics used in vehicles, buildings and household goods can remain in use for decades. This means that the ‘stock’ of plastic in commercial and household settings is constantly increasing. Material Economics (2022) estimates that the European ‘plastic in stock’ amounts to around 550 million tonnes. It also means that non-packaging plastics, while accounting for up to 74% of demand, make up only 40% of annual plastic waste.

Source: Plastics Europe, 2019a, Plastics Europe, 2019b.

Click here for different chart formats and data

As evident from Figure 3, collection rates for plastic waste from most non-packaging sources are lower than collection rates for waste from the packaging sector. This is likely to be the result of the longer lifetime of non-packaging items, which leads to a build-up in homes and businesses of non-packaging plastic stocks — including both products in use and those no longer in use, but kept in storage. In addition, many non-packaging items contain complex mixtures of polymer types, often in combination with other materials. This complicates their segregation when discarded and means that they are often included in mixed waste sent to landfill or for energy recovery.

Policy background

Progress to increase recycling rates for packaging waste has outpaced progress in improving recycling rates of total waste generated. The EEA has noted that this reflects the importance of strong policies, including recycling targets, in driving improvements in waste management, as this waste stream is targeted by the EU acquis (EEA, 2021). One example of the outcomes of this policy focus is the well-established collection schemes for packaging materials. In comparison, arrangements for the separate collection of plastic items from household and commercial waste streams are less well developed, which contributes to lower recycling rates. The 2022 Circular Economy Package includes a range of further measures to put the packaging sector on track towards circularity (EC, 2022). This important step is expected to prompt significant changes in terms of reduced use of materials and increased recycling. Similar sustained and targeted attention could transform the management of Europe’s non-packaging plastics.

In recent years, several major policy actions have addressed plastics, identifying them as a priority issue with respect to the ambition to close material loops and promote a circular economy. Key documents in this regard include the Circular economy action plan and A European strategy for plastics in a circular economy. Despite this, there are significant differences between policies for packaging and non-packaging plastics, with a significantly stronger policy direction apparent for packaging, including extended producer responsibility schemes, material-specific recycling targets and reporting obligations.

Of the main sectors that use non-packaging plastics, the automotive and electronics sectors have mandatory EPR schemes, but not material-specific recycling targets. The construction sector has recycling targets, but again these are not material specific. Finally, for the wide-ranging household and leisure sectors, policy has not yet targeted the use and disposal of plastic items and equipment used in these activities.

Without targeted actions, the amount of non-packaging plastic waste that is not recycled is expected to grow, and this will pose significant challenges for future generations in terms of resource loss and leakage into the natural environment. Moreover, given the general longevity of these plastics, it is essential that design and production approaches are changed now, to ensure the circularity of plastic material streams in the future. This is particularly relevant in the context of promoting clean material streams, so recycling does not carry a risk of toxic substances being recirculated through legacy contaminants in waste materials.

Country analysis

A limited number of inventory studies are available on plastic flows at national level, although such data are available from Germany, Netherlands, Sweden and Switzerland. These data complement data sets from Eurostat and industry sources by providing estimates of the amounts of plastic put on the market in each country. Sometimes, they also provide details of plastic flows for specific product streams, such as furniture and toys. Methods used for calculating these flows are varied and include the use of modelling, surveys and trade statistics. Standardised national inventories on plastic flows from other countries would help to build a better understanding of material flows, and strengthen policy implementation.

Table 1 provides an overview of findings from these studies and confirms that a high share of plastics is used for non-packaging functions. The data also illustrate local contexts and show variance between countries in terms of the percentage of plastics consumed by different sectors, such as the construction and automotive sectors.

|

Germany | Netherlands | Sweden | Switzerland |

| Packaging |

27% |

28% |

33% |

35% |

| Construction |

24% |

15% |

26% |

22% |

| Automotive |

9% |

3% |

21% |

6% |

| Electronics |

8% |

3% |

6% |

5% |

| Agriculture |

|

|

3% |

1% |

| Household |

|

40%(a) |

|

22% |

| Textile |

|

11% |

|

9% |

| Others |

32% |

|

11% |

|

Note: (a) Figure incorporates remaining plastic flows not included in the other categories.

Source: ETC/CE (2022).

Data challenges

Information is currently lacking on the overall magnitude of plastic consumption and plastic waste generation in Europe. One problem is that data on plastic consumption and waste in Europe are based on the assumption that consumption is equal to demand from European plastic converters. Although industry data provide valuable insights into sectoral activity levels and are therefore often used to characterise European plastic consumption, these figures exclude the significant volume of plastic used in textiles or embedded in products imported from outside the EU.

Plastic packaging is the only plastic waste stream in the EU directly controlled by legislation. Unsurprisingly, it is also the plastic waste stream that is best documented. Data on the less-regulated non-packaging plastic (waste) streams are lacking. This makes strategic management difficult, since less evidence is available to inform policy development and monitor the effects of interventions. The lack of data on non-packaging plastics also hampers decision-making on investing in infrastructure for the future management of plastic waste.

To allow comparative and complementary analyses of the European plastics sector, a standardised methodology should be developed to produce an inventory of non-packaging plastic flows that draws on a diverse set of data sources. The insight provided by such an inventory would be further strengthened by better data on product flows, including on the large quantities of plastics embedded in products imported to the EU and on the aftermarket movements of non-packaging plastics.

Although establishing a reporting framework for non-packaging plastics would require significant investment and effort, the additional data would provide the basis to transform the management of this critical yet somewhat overlooked material stream. This would be in line with policy directions set by the 2020 circular economy action plan.

At present, the current monitoring and regulatory focus on packaging potentially overlooks a significant fraction of the plastics consumed in Europe. This issue must be addressed if Europe is to better manage total plastic flows in the context of transformation to a circular economy.

Document Actions

Share with others