All official European Union website addresses are in the europa.eu domain.

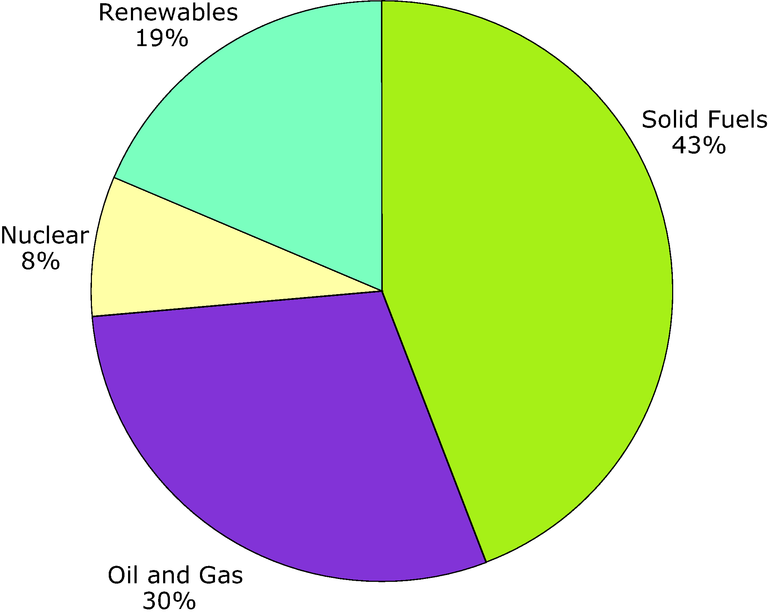

See all EU institutions and bodiesIndicative estimate of the distribution of energy subsidies in the EU-15, 2001

Chart (static)

These figures are based on a synthesis of existing reports and data

- Austria

- Belgium

- Denmark

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Luxembourg

- Netherlands

- Portugal

- Spain

- Sweden

- United Kingdom

Subsidies to electricity generation and consumption have been allocated to individual fuel sources on the basis of Eurostat 2001 data on primary energy inputs in the generating mix. There is no agreed definition of energy subsidies among Member States. The most transparent way of understanding them is to identify those that appear on budget and those that are off budget. On-budget subsidies are cash transfers paid directly to industrial producers, consumers and other related bodies, such as research institutes, and appear on national balance sheets as government expenditure. Grants may be given to producers, mainly to support commercialisation of technology or industry restructuring, and to consumers. On-budget subsidies also include low interest or reduced-rate loans, administered by government or directly by banks with state interest rate subsidy. Off-budget subsidies are typically transfers to energy producers and consumers that do not appear on national accounts as government expenditure. They may include tax exemptions, credits, deferrals, rebates and other forms of preferential tax treatment. They also may include market access restrictions, regulatory support mechanisms such as feed-in tariffs, border measures, external costs, preferential planning consent and access to natural resources. Quantifying off-budget subsidies is complex, in some cases impossible. It often requires that the benefit be calculated on the basis of differential treatment between competing fuels, or between the energy sector and other areas of the economy.